Inventory is an essential source of potential revenue. Whether your business handles components, raw materials, or finished products. It’s a significant investment and makes up a crucial part of your total current assets. With the global inventory management market expected to reach USD 3.89 billion by 2030 and grow at a 7.10% CAGR, it’s clear that businesses are placing even more focus on how they track and manage inventory.

Before determining how inventory should be classified on the balance sheet, it’s essential to understand what inventory represents. How it behaves within the business cycle, and what influences its financial treatment.

This guide explores how inventory is categorized. Let’s understand why inventory is a current asset, how to calculate it, and the best ways to manage inventory.

What Is Inventory?

Inventory, or stock, includes the goods and materials a business holds for resale, production, or use. It includes both raw materials used in production and finished goods that are available for sale. The purpose of holding inventory is to facilitate resale or production. Determining the shape and placement of these stocked goods is called inventory management.

Inventory on the balance sheet is considered a current asset alongside liabilities and owner’s equity. Many business owners often ask is inventory an asset or liabilities, and the answer is simple, inventory is an asset because it brings future economic value.

- It is not a fixed asset like equipment.

- It is not an expense unless it is sold and recorded under the cost of goods sold.

As a business owner, you must aim to predict consumer demand as accurately as possible to prevent having too much or too little inventory.

Keep reading if you’re interested in learning how to manage your inventory and assess your stock accurately and effectively.

Types of Inventory

Here’s an overview of the main types of inventory:

Raw Materials

These can include:

- Commodities like fabrics, steel, or lumber.

- Components such as electric motors, wire, or microchips are purchased by businesses to produce goods. For example, a manufacturing company may need precious metals and steel as raw materials.

Work in Progress

This category includes all products that are not yet finished or ready for sale. Examples include:

- Unassembled parts of a car.

- Unbaked pottery.

Finished Goods

These are complete products that are ready for sale, including:

- Packaged food items like a box of cookies

- High-value items such as an expensive sports car

Is Inventory a Current Asset or a Fixed Asset?

Inventory is classified as a current asset because businesses expect to sell it within the following year. This expectation is why inventory appears under current assets on the balance sheet.

Why Is Inventory a Current Asset?

Inventory is classified as a current asset because it’s expected to be sold and converted into cash within one cycle count. This is why inventory is a key liquidity resource and appears as a current asset in the balance sheet. Under the standard inventory assets definition, an item qualifies as a current asset if it can reasonably turn into cash within 12 months. This includes:

- Accounts receivable

- Supplies

- Short-term investments

- Prepaid expenses

Since inventory typically moves through the sales process quickly, it does not meet the criteria of a fixed asset and is not considered a non-current asset. This classification helps lenders, investors, and accountants assess a company’s short-term financial health and operational efficiency.

Is Inventory Always a Current Asset?

In most industries, inventory is consistently treated as a current asset because it is expected to be sold within a single operating cycle. However, certain sectors, such as aerospace and large construction, may hold inventory for longer periods due to extended production timelines or low inventory turnover rates.

In these cases, inventory may functionally resemble a long-term resource, but accounting standards still classify it as a current asset unless a business intends to hold it for more than 12 months. To clarify the distinction:

- Inventory is not a fixed asset

- Inventory is not a non-current asset in typical operations

- Inventory is an asset, not a liability

- COGS is an expense, not an asset or liability, even though it is derived from inventory

This ensures inventory remains consistently reported and comparable across industries.

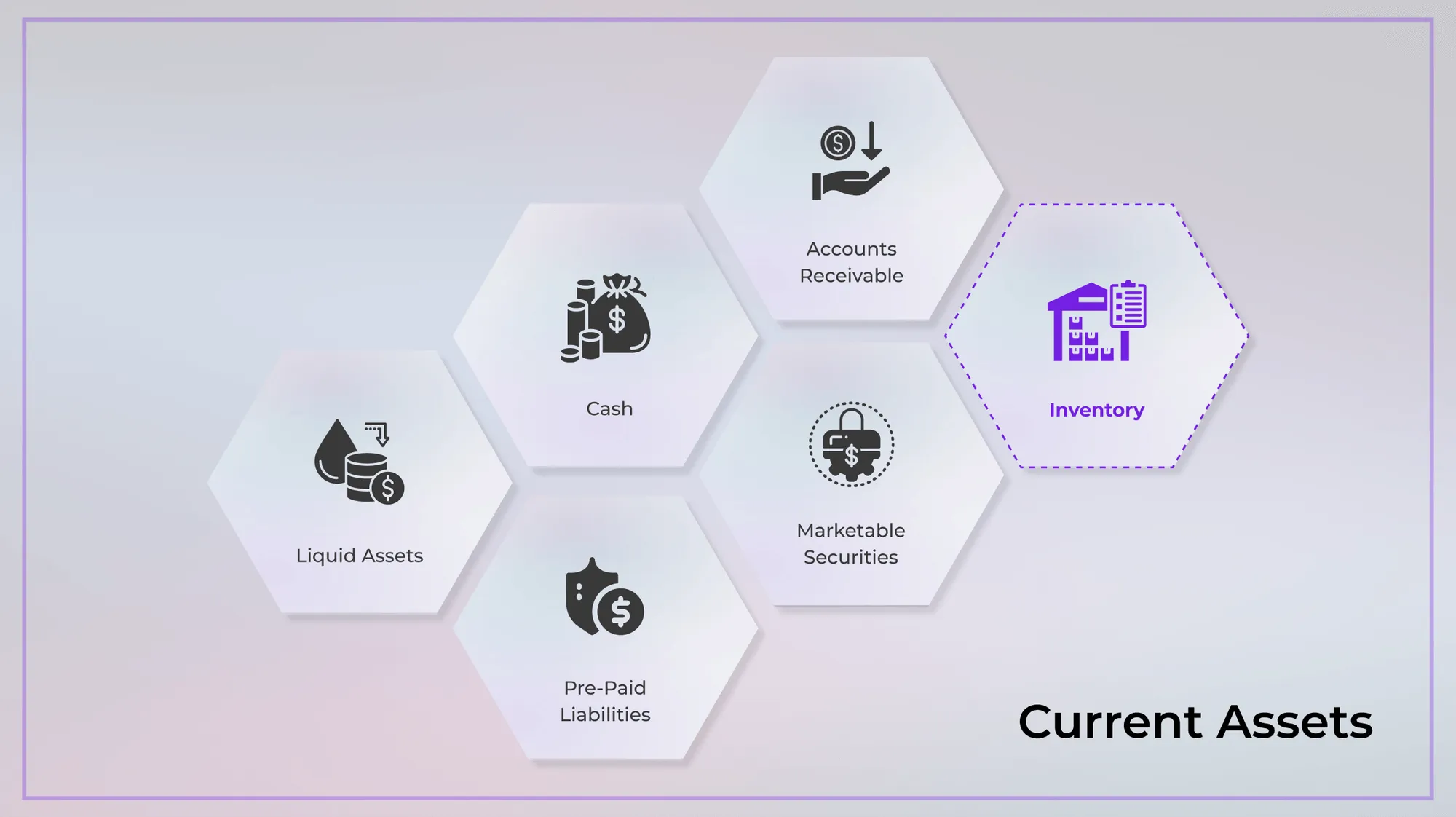

Current Assets

Current assets are resources a business expects to sell, use, or convert into cash within the current fiscal year or operating cycle. They support day-to-day operations and help maintain liquidity. Common types of current assets include:

- Cash and cash equivalents: The most liquid assets.

- Accounts receivable: Payments owed by customers.

- Inventory: Goods held for sale, typically converted into cash within one year.

- Marketable securities: Short-term investments.

- Prepaid expenses: Advance payments for services used within the year.

- Other liquid assets: Assets that can be quickly converted to cash.

For example, if grocery company ABC generated $12,980 million in first-quarter revenue, its current assets might include:

- Cash and cash equivalents ($250 million)

- Accounts receivable ($1,950 million)

- Inventory ($8,500 million)

- Marketable securities ($700 million)

- Prepaid expenses ($600 million)

- Other liquid assets ($1,150 million)

Fixed Assets

Fixed assets, or noncurrent assets, are long-term tangible resources a business owns and uses to deliver goods or services. They provide financial benefits over multiple years and are not easily converted into cash. Fixed assets commonly include:

- Equipment: Machinery and tools used in operations.

- Property: Land and buildings.

- Furniture and fixtures: Long-lasting operational items.

- Vehicles: Used for transportation or service delivery.

- Plant and production assets: Facilities used in manufacturing.

Unlike current assets that support short-term liquidity, fixed assets generate long-term value. Inventory, for example, is not a fixed asset because it is expected to be sold and converted into cash within one business year.

Special Considerations

Effective inventory management depends on understanding how valuation methods, turnover, and impairment affect financial reporting and operational performance. These factors help maintain accurate balance sheets and support better decision-making.

Valuation Methods

Inventory valuation determines how costs move from inventory to the income statement. Because prices change due to market shifts, spoilage, obsolescence, or fluctuating demand, accurate valuation is essential.

FIFO:

- Uses the oldest costs for COGS.

- Results in lower COGS and higher gross profit due to inflation.

- Leaves ending inventory valued at newer, higher costs.

LIFO:

- Uses the newest costs for COGS.

- Results in higher COGS and lower gross profit in inflation.

- Leaves ending inventory valued at older, lower costs.

Weighted Average Cost:

- Smooths price fluctuations over time.

- Produces moderate COGS and ending inventory values.

- Less affected by short-term cost volatility.

Inventory Turnover

Inventory turnover shows how quickly a business sells and replaces inventory.

- High turnover: strong demand, efficient inventory flow, and lower holding costs.

- Low turnover: weak sales, excess stock, and higher risk of obsolescence.

Formula: Inventory Turnover = COGS / Average Inventory

Impairment

Inventory impairment occurs when its market value drops below its recorded value.

- Reflects reduced recoverable value.

- May result from damage, spoilage, obsolescence, or market decline.

- Requires a write-down to ensure accurate financial reporting.

Understanding the Current Assets Formula

To calculate your total current assets, subtract the total of your current liabilities from your total current assets. This figure represents your business's net value (before taxes and interest) at any given time, commonly referred to as its book value or shareholders' equity.

How to Calculate Inventory

To calculate beginning inventory, first determine the cost of goods sold (COGS). Then, add the value of the most recent ending inventory and subtract the total spent on new inventory purchases. The formula can be expressed as:

(COGS + Ending inventory) - Purchases

Make Inventory Management Easier With PackageX

PackageX helps teams modernize inventory control by replacing manual processes with inventory management automation. Whether inventory is a current asset in the balance sheet or a critical operational resource, PackageX ensures you always know what you have, where it is, and how it’s moving.

Digitized Item Logging and Inventory Tracking

PackageX replaces spreadsheets and paper logs with automated, app-based workflows that help teams:

- Log individual items or bulk receipts through a mobile device

- Capture item photos and attributes as part of their inventory assets definition

- Maintain consistent records across multiple sites

Real-Time Inventory Visibility

Teams get an always-accurate picture of on-hand stock thanks to:

- Instant inventory updates as items are received, counted, or fulfilled

- A visual activity log showing all items moving in and out of each location

- Automated syncing between physical operations and digital records

AI-Powered Scanning and Document Digitization

PackageX uses advanced AI scanning to digitize logistics documents and convert them into actionable inventory data. Teams can:

- Scan barcodes, QR codes, pallets, or cartons using any mobile device

- Auto-update inventory levels and reduce manual data entry

- Accelerate receiving, picking, and fulfillment workflows

FAQs

What is an example of a current assets inventory?

A good example would be unsold merchandise in a retail store, often called backstock. Since inventory is expected to be sold and turned into cash within a year, it’s classified as a current asset.

Is inventory always a current asset?

In most cases, inventory is classified as a current asset since it can usually be sold within a year. However, there are certain situations where inventory might be considered a long-term asset, such as when it takes longer to sell or liquidate.

Is merchandise inventory a current asset?

Merchandise inventory is a current asset on a retailer's balance sheet. Current assets are assets that will be used up or converted to cash within the next year. Merchandise inventory qualifies as a current asset because it is anticipated to be sold within the fiscal or calendar year.

.webp)