This is a part of a series of data-based analysis on packages received by universities & colleges in 2021. The coworking analysis can be found here. If you’ve read that piece already, please skip over the next two sections to “01 – Number of Received Packages.”

Students have always been more tech-savvy than most & this shows in the data. Their online shopping behavior has resulted in more packages received at the campus mailrooms but they’re also more prompt in picking up their packages compared to recipients in other industries.

The Data

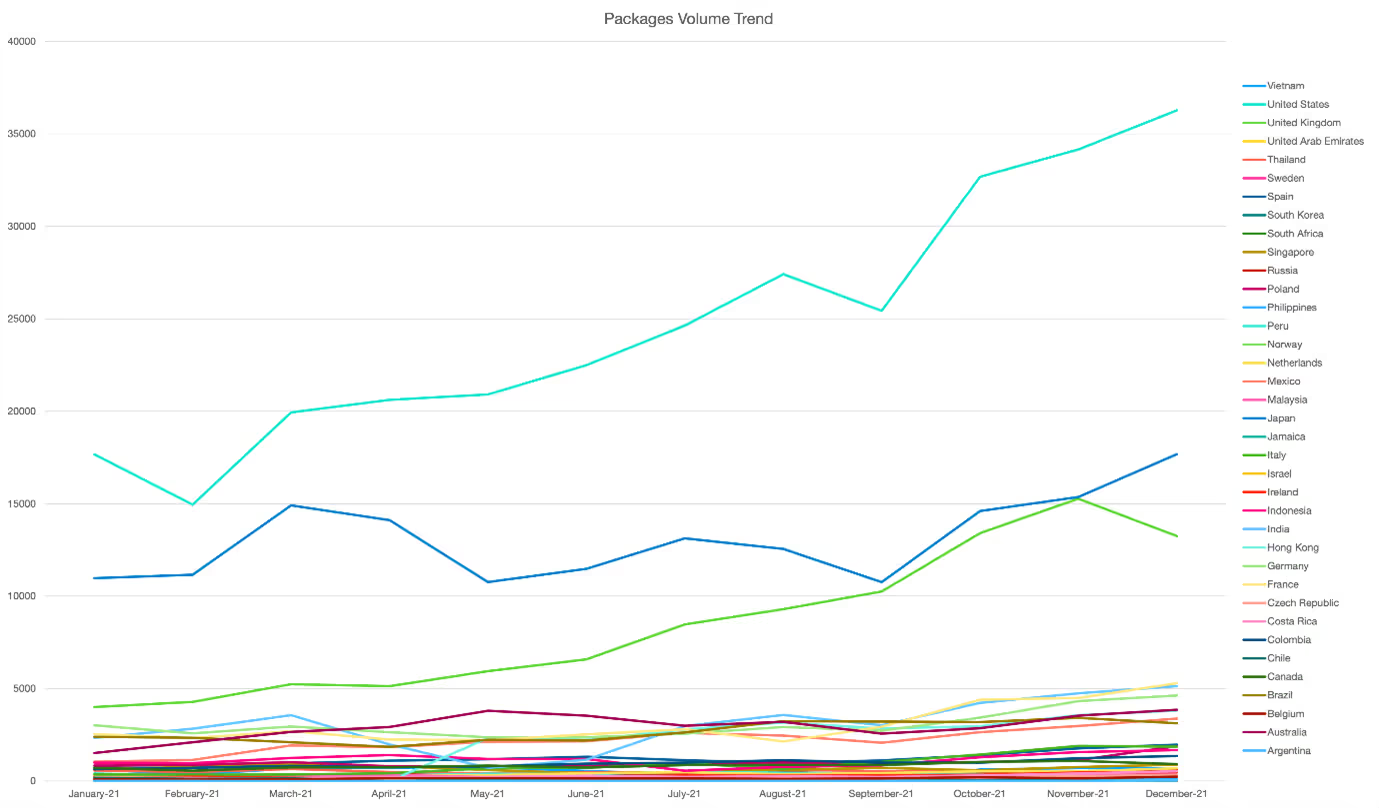

The data comprises of over 1.6 million packages processed by the PackageX platform across 40 countries.

The Stats

One thing is for certain – package volumes are increasing regardless of country & industry. This change in shopping behavior seems to be irreversible & here to stay.

01 - Number of Received Packages

Despite the sporadic lockdowns, whether partial or whole in some countries, the overall trend of packages received by education increased through till September. The only dips happened during the holiday seasons.

Analysis

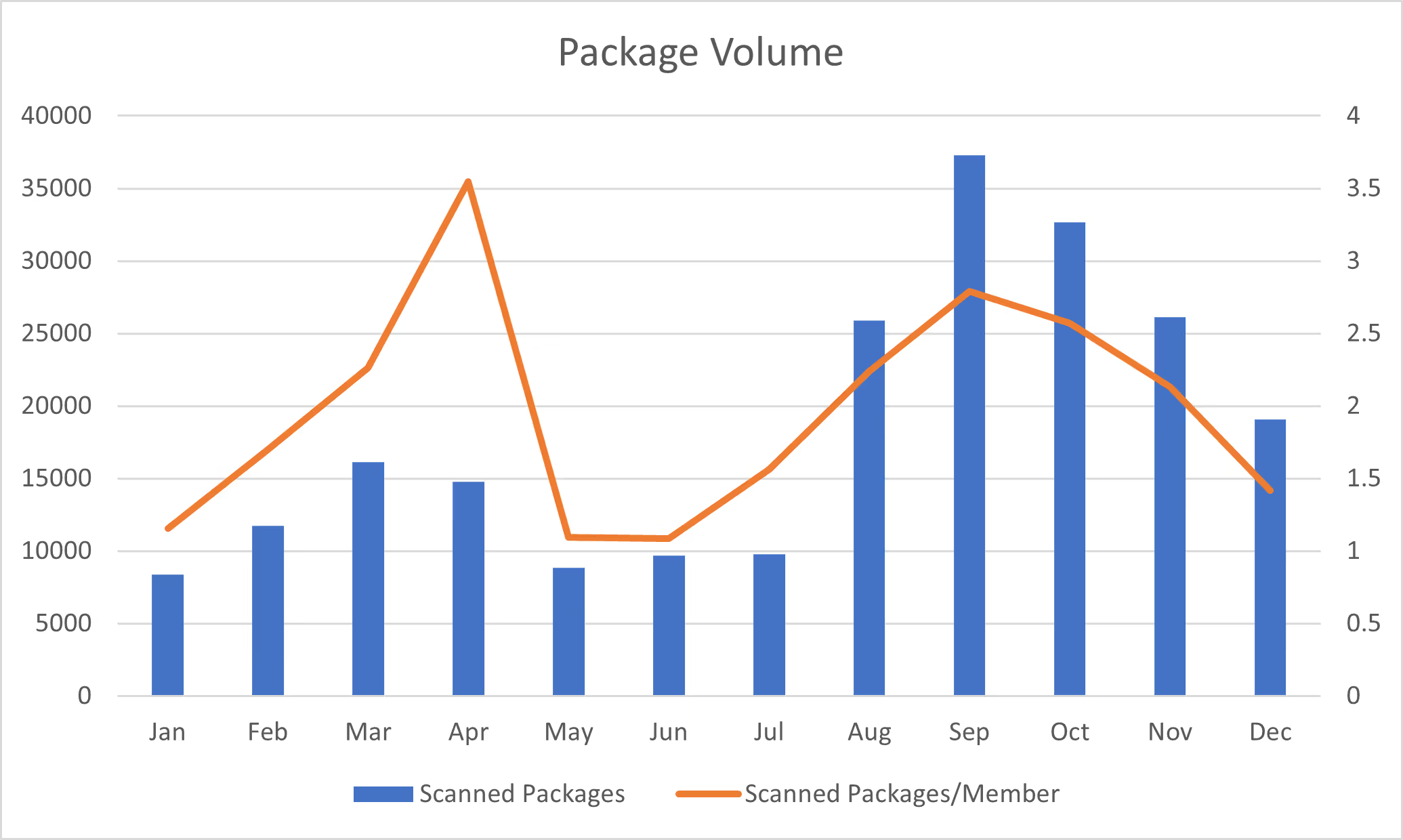

The average number of packages received per student & faculty member varied from its lowest of 1.08 per month to 3.5 per month. This is a very large range and an operational nightmare for most universities & colleges.

Compared to all non-education organizations on the PackageX platform, this range is much larger which is reflective of the seasonality of campus housing occupancy.

Key Considerations

- How can campus mailrooms build enough flexibility in their operations to manage X number packages in one month and 3.5X in another without wasting precious resources such as space & manpower?

- How can you effectively plan your mailroom operational requirements based on seasonality?

02 – Same-day Package Pickups

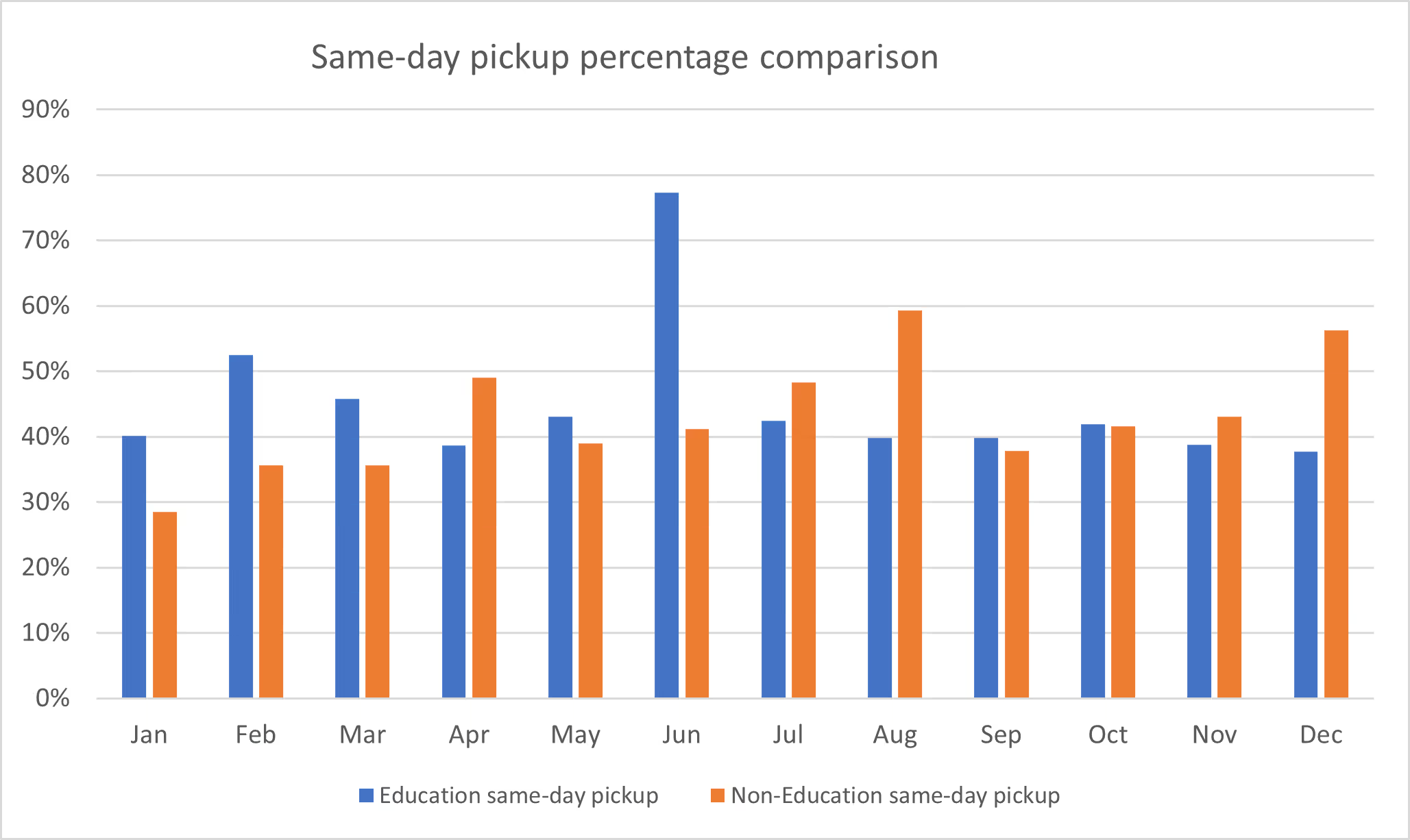

Same-day pickups percentage is the number of packages that were picked up by the recipients on the same day they were received by the mailroom as a percentage of overall packages received.

Analysis

The same-day pickup rate did not deviate much throughout the year except for the outlier month of June which can be attributed to the summer break.

Compared to other industries, same-day pickup rates are on par with others with major deviations coming in during major holiday seasons.

Key Considerations

- How does your same-day pickup rate compare with your peers?

- Is your automated notification & reminder strategy based on data showing the best times to remind recipients?

- What’re the best practices that education organizations can adopt to increase this metric and reduce mailroom storage requirements?

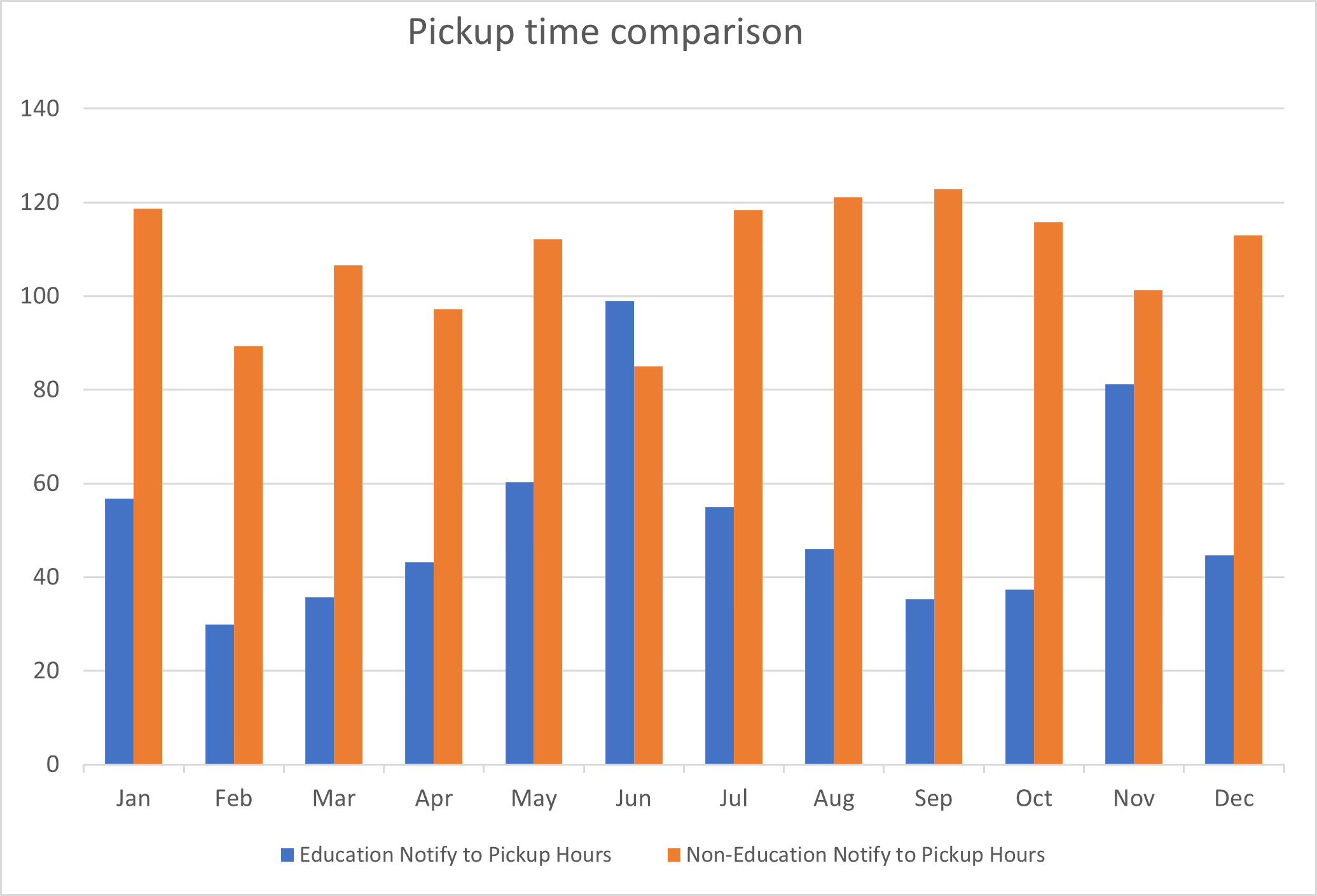

03 - Notify to Pick up Time Comparison

This metric is the duration spent from the time that a recipient is notified through an email or text to the time that they pick up that package.

Analysis

Except for the holiday months, students & faculty have shown to be prompt in picking up their packages in comparison with other industries. The holiday months data is skewed somewhat by students & faculty members receiving packages at the campus but not being available for the next x number of weeks to pick them up.

Focusing only on the blue columns, however, a disparity emerges which again points to the seasonality. The shortest time from notification to pickup was ~30 hours while the longest was ~99 hours. This is a 3.3X difference which shows how much flexibility campus receiving centers need to build into their operations such as storage & manpower.

Key Considerations

- The longer packages stay in the mailroom, the more the chances of losing or misplacing them. How can universities & colleges put in place processes & mechanisms to safely store & retrieve packages?

- Students & faculty members are usually quick in picking up their packages, but the seasonality adds to campus mailroom storage requirements. Are there any policy changes that can incentivize swifter collection of packages?

- How does your campus fare in comparison to the average annual pickup time of 51 hours – which is a little more than 2 days.

{{returns-webinar}}

Key Takeaways

Here’re the key takeaways that campus services managers, housing facility supervisors & mailroom managers should consider in their 2022 planning:

- Benchmarking your operations is the first step to improvement. Use the above three metrics to understand where you stand & where’s the biggest gap.

- Root cause analysis – increase in recipient complaints about lost or misplaced packages can be for a variety of reasons. Rather than just opting for whatever is receiving the maximum buzz in the industry, analyze the cause of the symptom & then brainstorm possible solutions.

- Recipient experience – We live in a mobile-first world. How is your receiving center connected to your students & faculty right now? In the past two years, how’ve your mailroom operations changed to cater to the change in students & faculty online shopping behavior?

- Revenue opportunity – there’s potential to differentiate your mailroom services and offer premium services such as Digital Mailrooms. Allow your recipients to receive their mail digitally or physically regardless of their location by offering scan & send services. Another key Digital Mailroom service is the ability to forward received packages.

- Community – connect & talk to peers to share & learn new best-practices.

About PackageX

PackageX is a comprehensive logistics management platform with a host of first-party & third-party apps. PackageX Receive (formerly called Mailroom) is the premier inbound package management solution that automates key processes such as data entry (through its AI-powered OCR), notifications & reporting. Used by 100+ organizations across 17 countries, the PackageX platform is the logistics platform of choice for modern campus shipping & receiving centers.

.webp)